February 27, 2021

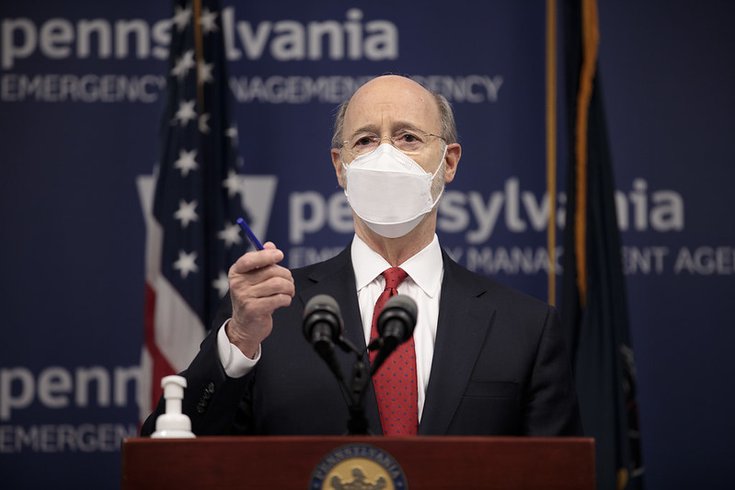

Source/Governor Tom Wolf/Flickr

Source/Governor Tom Wolf/Flickr

Pennsylvania Gov. Tom Wolf has called for an extraction tax on the natural gas industry every year since taking office in 2015.

Implementing an extraction tax on Pennsylvania's natural gas industry would provide the state with $3 billion Gov. Tom Wolf wants to spend on post-pandemic economic development during the next 10 years.

Wolf unveiled the plan recently as part of his Back to Work PA initiative.

In his latest call for a severance tax, Wolf said it would provide the state $300 million each year for the next decade – money that would go directly to fund Wolf's economic development package, a proposal which would help rebuild Pennsylvania's economy after the COVID-19 pandemic.

Wolf has proposed a natural gas extraction tax each year since taking office in 2015 to address gaps in the budget, according to The Morning Call.

Pennsylvania is the only gas-producing state in the U.S. without a severance tax on the natural gas industry. Natural gas producers only pay an impact fee to state and local governments.

The GOP-controlled state legislature in Harrisburg has consistently remained opposed to taxing the natural gas industry for extracting the state's natural resource. Republicans have argued the tariff would lead to higher energy costs for residents and negatively impact natural gas production jobs.

If passed by the state legislature, the Back to Work PA initiative would help modernize the state's workforce, find unemployed residents new career paths and put the state in a position to grow economically in the wake of the public health crisis, Wolf said.

"Pennsylvania needs a comprehensive, forward-thinking plan to jumpstart our economy and support our workforce," Wolf said.

He added, "Back to Work PA will make strategic and comprehensive investments to build a stronger and more diverse workforce, support Pennsylvania businesses while attracting businesses to the commonwealth, and assist communities with economic recovery efforts – all of which will help us get back on track and build a brighter future for Pennsylvania."

Among the proposed initiatives in Wolf's Back to Work PA economic development package are the following:

• Investing into job and digital literacy skills training programs to connect unemployed residents to new career opportunities.

• Expanding mentorship programs to include occupations such as health care, child care, information technology and manufacturing.

• Increasing child care subsidies, assisting employers in developing or expanding on-site child care services, assisting child care centers in broadening resources during non-traditional work hours and eliminating child care deserts.

• Making high-speed internet access available to all residents by building out infrastructure in unserved areas.

• Providing financial planning opportunities for municipalities in order to address revenue losses caused by the COVID-19 pandemic and prepare for possible economic disasters in the future.

Back to Work PA came about from the bipartisan Keystone Economic Development and Workforce Command Center's annual report in January 2020, which provided Wolf with a number of recommendations to bolster the state's economy. Among the suggestions were investments into transportation, child care and job training.

The economic initiative is just one aspect of Wolf's 2021 legislative priorities, which he unveiled during his annual budget address last month. Wolf also has proposed legalizing recreational marijuana, raising the minimum wage to $12 per hour and cutting taxes for working-class families.

Pennsylvania's unemployment rate currently stands at 6.7%. The state's unemployment rate reached its highest point during the COVID-19 pandemic last April when it hit 16.1%.

Follow Pat & PhillyVoice on Twitter: @Pat_Ralph | @thePhillyVoice

Like us on Facebook: PhillyVoice

Add Pat's RSS feed to your feed reader

Have a news tip? Let us know.