A new report shows the gender wage gap affects women well into their golden years.

The financial firm Financial Finesse conducted the report by evaluating men's and women’s median incomes, retirement savings, life expectancies and projected health care costs to determine how much they would need throughout their lifetime.

- Related Articles:

- Gender equality: What's in it for men?

- Bradley Cooper applauds Jennifer Lawrence's attack on Hollywood pay gap

- Emma Watson urges men to join gender equality battle

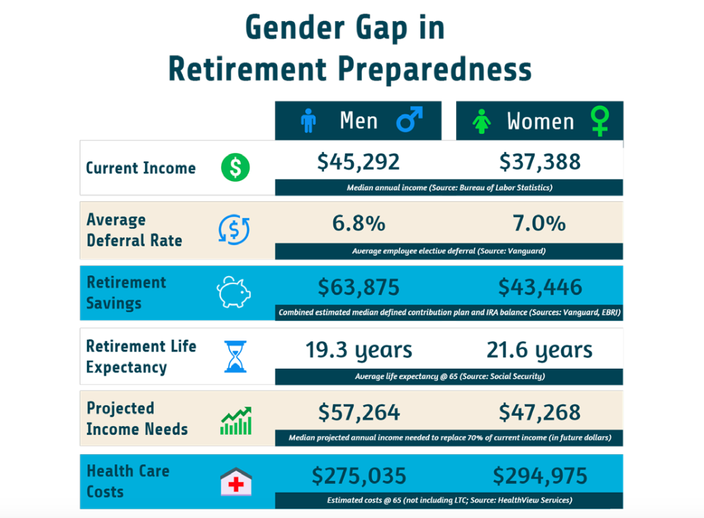

According to the report, the shortfall for women begins during their working years, when women who work full-time, year-round, make, on average, 78 cents for every dollar a man makes.

This leads to less savings for retirement, and that deficit is exacerbated by women’s longer life expectancy and higher health care costs.

In total, Financial Finesse found that a 45-year-old woman retiring at 65 will face a 26 percent savings gap. At the same time, that woman will need her money to stretch further.

For example, a woman is more likely than a man to take a break from working to care for a family member, further setting back her savings.

Read the full 2015 Gender Gap in Financial Wellness report here.