Advisors to the shuttered Revel Casino Hotel in Atlantic City, New Jersey, failed to get approval on Wednesday for an agreement to sell the hotel for $82 million and were told by a U.S. Bankruptcy Judge to look for a better price.

The decision by Judge Gloria Burns could open the door for a Los Angeles developer, Izek Shomof, whose attorney told Wednesday's court hearing he could offer more money.

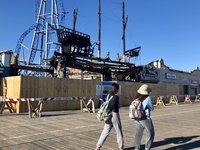

The ocean-front Revel has already lost two deals in the last six months, with the price dropping from $110 million to the current price. The massive hotel cost $2.4 billion to open in 2012.

"I think in order for me to be comfortable with this you need to satisfy me that every stone has been overturned to find the best deal," Burns said at hearing in Camden, New Jersey.

Revel had asked Burns to approve the sale agreement with Florida developer Glenn Straub, who had failed to close a prior sale agreement. The current agreement required Straub to close the deal by March 31.

Shomof's lawyer urged Burns to delay approving the Straub sale and also complained the current sale process was unfair. He said his client was barred from performing due diligence and said Straub had been threatened to sue him for interfering with the Revel sale.

Although Burns only postponed a ruling for a week, Revel's advisors and lawyers for other parties urged her to take the certainty of a sale to Straub, given how difficult it has been to find a buyer for Revel. The casino filed for bankruptcy in June and closed three months later as it struggled to find a buyer.

The bankruptcy is being funded by a loan from Wells Fargo, and the bank's lawyer warned Wells might withdraw its support if Burns delayed approving a sale agreement with Straub.

"Then maybe a conversion to a Chapter 7 is the right way to go," Burns said in response. While Chapter 11 allows for a reorganization, Chapter 7 bankruptcy is a piece-meal liquidation overseen by an independent trustee.

Atlantic City's gambling market has declined dramatically in recent years as neighboring states have embraced casinos.

Earlier this year New Jersey's governor, Chris Christie, appointed an emergency manager to oversee the strained finances of Atlantic City, where four of the resort's 12 casinos closed last year.