September 22, 2021

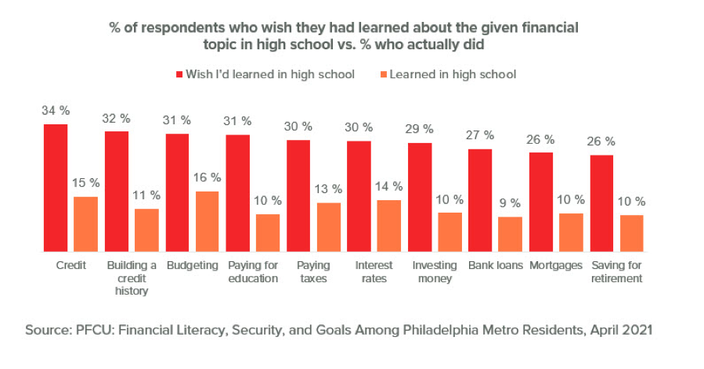

Financial literacy and personal finance education should be a top priority throughout all stages of life, yet a recent survey conducted among Philadelphia Metro Area residents shows that it’s absent from one crucial place: schools. The survey uncovered that high school is the most common place that Philadelphians wish they had learned about all elements of finance, but in fact, very little financial education is happening in schools. This must change in order to increase the financial literacy of Philadelphia overall, ensuring that residents can not only survive, but thrive financially.

Perhaps one of

the most illuminating findings from the survey is that Philadelphians

reported they were unhappy with the way they learned about finance, despite

expressing feelings of confidence in their current financial situation. In

fact, only 16% of respondents reported that they are happy with how they

learned about finance, which means that we, as credit union leaders, have

work to do when it comes to providing financial education.

Philadelphians have expressed that this type of education is something they desired at a young age, yet it was not made available to them. This is something we hope to see change over time, and while school districts largely dictate what is taught in the classroom, finance leaders can get creative in how they supplement traditional learnings with valuable finance content. To do this among middle school students in Philadelphia, PFCU partnered with Spark, a Philadelphia-based nonprofit organization that provides middle school students opportunities centered around career exploration, to host a creative contest in celebration of Financial Literacy Month.

The 2021 Virtual Financial Literacy Creative Contest offered the younger generation an opportunity to share, in their own words, what financial literacy means to them in their current stage of life, as well as what financial goals they had set for the next 5, 10, or 15 years. Each student was encouraged to submit a creative essay, poem, or piece of artwork about what financial security means to them for a chance to win the grand prize ($500), second-place prize ($300), or third-place prize ($200). The winning submissions from the students put the true meaning of “financial security” into perspective, specifically with regards to the winning essay submission.

“Financial security not only means to me that I am not concerned about whether my income or money can cover my living expenses, but it also means that I have quite enough money saved for my future financial goals and needs,” wrote the grand prize recipient, Samia Hossain, in her essay submission about financial security. Samia also incorporated lessons from her parents into her essay, noting that they had saved money to buy a new home to provide more space for their growing family—a financial goal that inspired Samia’s point of view around financial security. Hearing firsthand from the younger generation that there is an urgent desire to achieve financial security in the future only further reinforces that this work needs to become a top priority for finance leaders nationwide.

Whether through an engaging creative contest, short-form videos on social media, or a career-based workshop, there are so many different ways to educate the next generation on responsible financial habits and behaviors. By making a continuous concerted effort to reach students at any age using these methods of financial education, we hope to see Philadelphians increase their own sense of financial literacy and ultimately achieve their financial goals.

To view the full research report, click here.