April 25, 2015

Matt Rourke/AP

Matt Rourke/AP

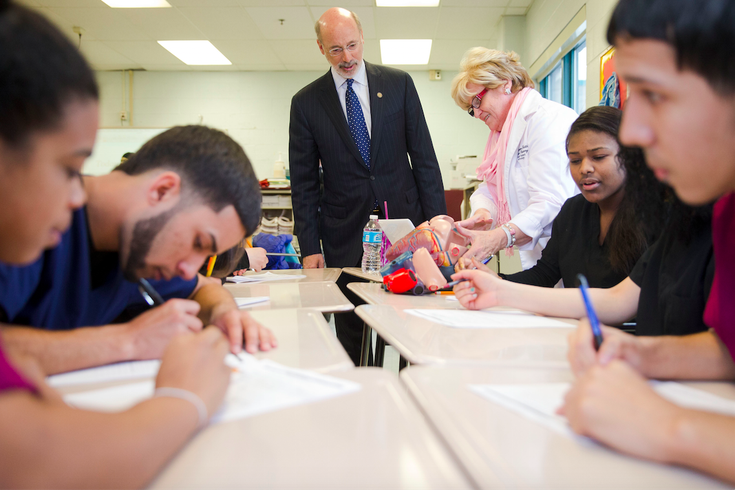

Gov. Tom Wolf meets with students as he tours Kensington Health Sciences Academy on Thursday, April 9, 2015, in Philadelphia.

Last month, Pennsylvania Governor Tom Wolf released a budget proposal that he emphasized would give more spending power to the middle-class families as a result of favorable tax cuts.

While the highlights of the governor's proposal display ambitious goals in the areas of education, property taxation, and economic development through fiscal reform, the plan absorbed pointed criticism from the state Legislature's nonpartisan Independent Fiscal Office, The Morning Call reports.

The full report, which can be downloaded at the IFO website, effectively predicts that Wolf's plan will result in higher taxes across all income brackets.

To complete its analysis, the IFO projected models over the next four years, encompassing nine of the proposed tax changes as they would impact income brackets based on adjusted IRS statistics. Via The Morning Call:

Residents in the lowest income bracket (up to $25,000) would pay $8 million more in taxes in fiscal year 2018-19, the IFO found. By that same year, the middle class ($50,000 to $74,999) cumulatively would pay $503 million more to the state. The highest income bracket (above $250,000) would see taxes go up a combined $1 billion. The net impact across all income brackets would be $3.6 billion in 2018-19, IFO found.

While the report suggests higher taxes might reduce economic activity, it also acknowledges that higher government spending offset some of the economic impact.

A Franklin and Marshall College Poll published last month found that 59 percent of Pennsylvania voters support Wolf's budget plan. In particular, voters favored the $400 million funding increase for basic education, the reduction in property taxes, and the replacement revenue shortfalls with an extraction tax for Marcellus Shale drilling.

Republicans lawmakers have taken the IFO report as a sign Wolf's budget proposal is a tax grab and that it would increase state spending without tangibly benefitting families.

Governor Wolf's office has since countered the report and Republican criticism, defending its own calculations based on more accurate information about consumer spending in Pennsylvania. Spokesman Jeff Sheridan released the following statement.

"The Department of Revenue has access to more sophisticated information on consumer spending habits, which is why we are confident that Gov. Wolf's plan will deliver tax relief to middle-class families and seniors."

A large part of the debate boils down to how Wolf's proposed hikes in personal income and sales taxes can effectively be offset by lower property taxes, such that those most in need of relief won't be hit with higher overall taxes as consumers. even if the proposal lays out a progressive tax scheme overall.

Still, the IFO report describes Wolf's fiscal proposal as a progressive tax scheme, suggesting that two-thirds of the total new tax burden would fall on wealthier Pennsylvanians, while one-tenth would be shouldered by the lowest-income earners, Newsworks reports.

The challenge ahead for Wolf will be to push the proposal through a Republican-controlled House and Senate. While the IFO report could make that task more difficult, it also foresees the kind of criticism Wolf's plan will face in the Legislature, enabling time for corrections, revisions, and statistical comparisons.

The IFO will in turn be open to an adjustment of its analysis if it is provided with new data, according to Matthew Knittel, the agency's executive director.